Frequently Asked Questions

Home > Knowledge Center > Frequently Asked Questions

Frequently Asked Questions

Welcome to our FAQ page! Here you’ll find answers to the most common questions about securing a mortgage, helping you navigate your journey towards home ownership with confidence.

What’s a Mortgage?

Good question! A mortgage is a loan you use to purchase a home. It’s a legal agreement in which a mortgage lender pays for your house in full with the expectation that you will repay them back (with interest) over a set period of time. Mortgages allow homebuyers to purchase homes even if they don’t have all the money immediately available to purchase them upfront.

Let’s go over a few more common terms you’ll hear:

. Loan Officer – the mortgage adviser in charge of your file. They’ll help you from beginning to end.

. Interest Rate – The amount of money paid for the ability to borrow money. Expressed in percentage-form.

. Closing – Closing encompasses the final steps in the transfer of property ownership. The buyer signs all final documents and the seller receives funds.

. Credit Score – A number that represents a consumer’s credit worthiness. Lower scores pose a greater risk of default (no longer being able to pay your mortgage). Higher scores tell lenders that you’re less likely to default.

What is an APR?

The annual percentage rate (APR) is an interest rate reflecting the cost of a mortgage as a yearly rate. This rate is likely to be higher than the stated note rate or advertised rate on the mortgage, because it takes into account points and other credit costs. The APR allows homebuyers to compare different types of mortgages based on the annual cost for each loan. The APR is designed to measure the “true cost of a loan.” It creates a level playing field for lenders. It prevents lenders from advertising a low rate and hiding fees.

The APR does not affect your monthly payments. Your monthly payments are strictly a function of the interest rate and the length of the loan.

Because APR calculations are effected by the various different fees charged by lenders, a loan with a lower APR is not necessarily a better rate. The best way to compare loans is to ask lenders to provide you with a good-faith estimate of their costs on the same type of program (e.g. 30-year fixed) at the same interest rate. You can then delete the fees that are independent of the loan such as homeowners insurance, title fees, escrow fees, attorney fees, etc. Now add up all the loan fees. The lender that has lower loan fees has a cheaper loan than the lender with higher loan fees.

The following fees are generally included in the APR:

. Points – both discount points and origination points

. Pre-paid interest. The interest paid from the date the loan closes to the end of the month.

. Loan-processing fee

. Underwriting fee

. Document-preparation fee

. Private mortgage-insurance

. Escrow fee

. The following fees are normally not included in the APR:

. Title or abstract fee

. Borrower Attorney fee

. Home-inspection fees

. Recording fee

. Transfer taxes

. Credit report

. Appraisal fee

What does it mean to lock the interest rate?

Mortgage rates can change from the day you apply for a loan to the day you close the transaction. If interest rates rise sharply during the application process it can increase the borrower’s mortgage payment unexpectedly. Therefore, a lender can allow the borrower to “lock-in” the loan’s interest rate guaranteeing that rate for a specified time period, often 30-60 days, sometimes for a fee.

What documents do I need to prepare for my loan application?

Below is a list of documents that are required when you apply for a mortgage. However, every situation is unique and you may be required to provide additional documentation. So, if you are asked for more information, be cooperative and provide the information requested as soon as possible. It will help speed up the application process.

Your Property

Copy of signed sales contract including all riders

Verification of the deposit you placed on the home

Names, addresses and telephone numbers of all realtors, builders, insurance agents and attorneys involved

Copy of Listing Sheet and legal description if available (if the property is a condominium please provide condominium declaration, by-laws and most recent budget)

Your Income

. Copies of your pay-stubs for the most recent 30-day period and year-to-date

. Copies of your W-2 forms for the past two years

. Names and addresses of all employers for the last two years

. Letter explaining any gaps in employment in the past 2 years

. Work visa or green card (copy front & back)

If self-employed or receive commission or bonus, interest/dividends, or rental income:

. Provide full tax returns for the last two years PLUS year-to-date Profit and Loss statement (please provide complete tax return including attached schedules and statements. If you have filed an extension, please supply a copy of the extension.)

. K-1’s for all partnerships and S-Corporations for the last two years (please double-check your return. Most K-1’s are not attached to the 1040.)

. Completed and signed Federal Partnership (1065) and/or Corporate Income Tax Returns (1120) including all schedules, statements and addenda for the last two years. (Required only if your ownership position is 25% or greater.)

If you will use Alimony or Child Support to qualify:

. Provide divorce decree/court order stating amount, as well as, proof of receipt of funds for last year

If you receive Social Security income, Disability or VA benefits:

. Provide award letter from agency or organization

Source of Funds and Down Payment

. Sale of your existing home – provide a copy of the signed sales contract on your current residence and statement or listing agreement if unsold (at closing, you must also provide a settlement/Closing Statement)

. Savings, checking or money market funds – provide copies of bank statements for the last 3 months

. Stocks and bonds – provide copies of your statement from your broker or copies of certificates

. Gifts – If part of your cash to close, provide Gift Affidavit and proof of receipt of funds

. Based on information appearing on your application and/or your credit report, you may be required to submit additional documentation

Debt or Obligations

. Prepare a list of all names, addresses, account numbers, balances, and monthly payments for all current debts with copies of the last three monthly statements

. Include all names, addresses, account numbers, balances, and monthly payments for mortgage holders and/or landlords for the last two years

. If you are paying alimony or child support, include marital settlement/court order stating the terms of the obligation

. Check to cover Application Fee(s)

What are the qualification requirements to get a mortgage?

There are three main factors that come into play when being approved for a mortgage:

. Credit score. Each loan program has a minimum credit score requirement in order to qualify. Higher credit scores can allow you to qualify for lower interest rates, too.

. Down payment. Some loan programs require you to make a down payment of a certain amount.

. Debt-to-income ratio (DTI). Your debts should only make up a certain percentage of your income, because you’re about to incur a large and important debt by purchasing a home.

These are the credit score ranges that may affect your terms and ability to get approved for a mortgage:

. 300 to 579 – You may not qualify for any mortgage option

. 580 to 620 – This is the mortgage qualification starting point

. 720 to 850 – You may be eligible for the best rates and terms

Pre-Approval vs Pre-qualification: What’s the difference?

A pre-qualification is just your mortgage adviser’s estimate on your ability to buy a home. It’s based on your credit score and some other self-reported details. A pre-qual may give you a good idea on which loan program fits you best, and maybe even how much you’ll qualify for.

A pre-approval officially confirms how much you’re able to borrow. Your income and asset documents go through a more formal review. After getting pre-approved, you’re able to take a more serious look at buying a house. If you’re not able to get pre-approved, your adviser will be able to offer some helpful tips on raising your credit score, lowering your debt, or working through any other financial obstacles preventing you from buying a home.

Is buying a house really better than renting?

Most of the time, yes! The fact is, with renting, you’ll never have a chance to earn your money back. When you buy a house, you’re making steady progress toward owning your property. When your loan term is done, you’re no longer paying a mortgage. That’ll never happen when you rent. Plus, you have the opportunity to sell your home and make some money back.

Do I have to bring a 20% down payment to buy a home?

Probably not! There are loan options available that allow for 3.5% or even zero down. A 20% down payment will reduce your monthly payments and the total amount of interest you pay over the life of the loan, but it’s definitely not required for all borrowers.

Conventional, FHA, USDA, VA – What are the differences?

These are all examples of home loan programs that home buyers can choose from. We offer all four of these, plus several more options. Let’s take a quick look at what makes each unique. You can learn a lot more about each of these options by visiting our loan option pages.

. Conventional – Lower rates and fees for borrowers making a down payment with good credit

. FHA – Popular with first-time home buyers due to lower down payment requirements

. USDA – Zero-down options for rural borrowers in small towns

. VA – Competitive rates, zero-down options, and no private mortgage insurance (PMI) requirement for veterans, active service members, and their surviving spouses.

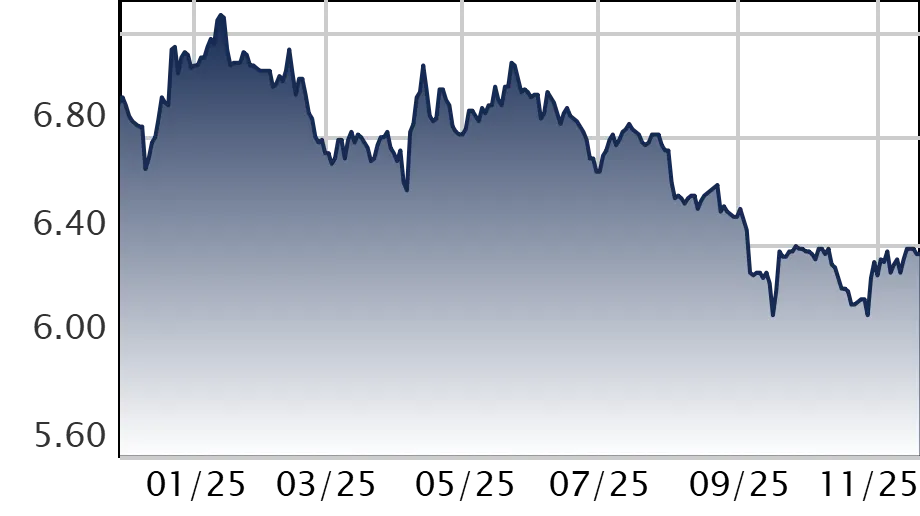

Today's Mortgage Rates

30 Year Fixed

| Product | Avg. Rate | Chg. |

|---|---|---|

| 30 Yr Fixed | 6.36 | -- |

| 15 Yr Fixed | 5.85 | -- |

| FHA 30 Yr | 5.98 | -0.01 |

| Jumbo 30 Yr | 6.43 | -0.01 |

| 7/6 SOFR | 6.05 | +0.02 |

| VA 30 Yr | 5.99 | -0.01 |