Home Loan Options

Home > Home Loan Options

Home Loan Options

Choosing the right home loan is a crucial decision in the home-buying process. It can impact your financial health and stability for years to come. This guide is designed to provide you with a detailed overview of the various mortgage options available today. Whether you are a first-time buyer or looking to refinance, understanding the pros and cons of each type of loan will help you make an informed decision tailored to your needs.

Conventional Loans

Overview: Conventional loans are private sector loans that are not guaranteed by the federal government but conform to the guidelines set by Fannie Mae and Freddie Mac.

Pros:

No private mortgage insurance required with a 20% down payment.

Flexibility in loan terms and payment options.

Potentially lower total borrowing costs if you have a strong credit score.

Cons:

Potentially lower total borrowing costs if you have a strong credit score.

Higher credit score and down payment requirements than government-backed loans.

Best Suited For: Borrowers with strong credit, stable employment history, and those who can afford a substantial down payment

FHA Loans

Overview: Insured by the Federal Housing Administration, FHA loans are designed to help lower-income borrowers purchase a home

Pros:

Smaller down payment required (as low as 3.5%).

Easier to qualify for than conventional loans.

Lower credit score requirements.

Cons:

Requires upfront and annual mortgage insurance premiums.

Loan limits that vary by region.

Best Suited For: First-time homebuyers and those with lower credit scores or smaller down payments.

VA Loans

Overview: Specifically for U.S. veterans, active-duty service members, and select military spouses, VA loans are backed by the Department of Veterans Affairs.

Pros:

No down payment and no mortgage insurance requirements.

Competitive interest rates and terms.

Lenient credit requirements.

Cons:

A VA funding fee that varies based on loan type and military category.

Only available to a specific group of borrowers.

Best Suited For: Eligible service members, veterans, and their families seeking affordable mortgage options.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

USDA Loans

Overview: USDA loans are intended to assist rural homebuyers and are guaranteed by the United States Department of Agriculture.

Pros:

No down payment required

Below-market interest rates.

Lower mortgage insurance costs.

Cons:

Geographic restrictions to less-dense areas.

Income limits apply.

Best Suited For: Individuals and families looking to buy homes in rural areas and who meet income eligibility requirements.

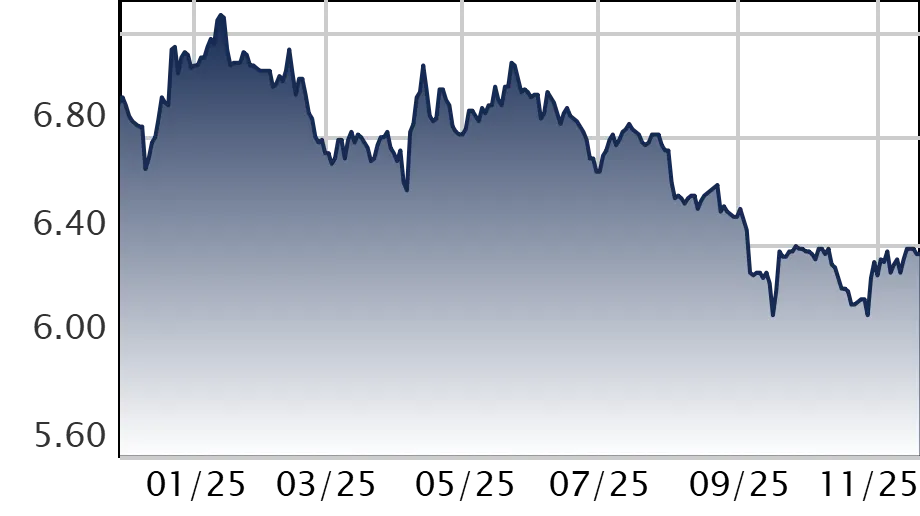

Today's Mortgage Rates

30 Year Fixed

| Product | Avg. Rate | Chg. |

|---|---|---|

| 30 Yr Fixed | 6.36 | -- |

| 15 Yr Fixed | 5.85 | -- |

| FHA 30 Yr | 5.98 | -0.01 |

| Jumbo 30 Yr | 6.43 | -0.01 |

| 7/6 SOFR | 6.05 | +0.02 |

| VA 30 Yr | 5.99 | -0.01 |

Jumbo Loans

Overview: For homes that exceed federal loan limits, jumbo loans are necessary to finance higher property values.

Pros:

Finance luxury homes and higher-priced properties that exceed conventional limits.

Competitive interest rates for qualifying borrowers.

Cons:

Higher down payments and reserve requirements.

More rigorous credit requirements and property appraisals.

Best Suited For: Buyers purchasing high-value properties with significant income and creditworthiness.

Fixed-Rate Mortgages

Overview: Offers the security of a consistent interest rate and monthly payment throughout the life of the loan.

Pros:

Stability in monthly payments, which makes budgeting easier.

Protection against interest rate increases.

Cons:

Higher initial rates compared to adjustable-rate mortgages.

Less flexibility to take advantage of lower rates without refinancing.