Benefits to Owning a Home

Home > Benefits to Owning a Home

Benefits of Owning a Home: A Guide for Prospective Buyers

Introduction

Deciding to purchase a home is one of the most significant financial decisions most people will make in their lifetime. Beyond the pride of homeownership, there are substantial benefits that come with owning a home. This guide explores the numerous advantages, from financial gains to personal and emotional rewards.

1. Financial Stability and Wealth Building

Build Equity: Homeownership is a powerful way to build equity. Each mortgage payment is an investment in your future, as it contributes to reducing the loan’s principal and increasing your home equity, unlike rent payments which benefit the landlord.

Tax Advantages: Homeowners can take advantage of various tax deductions that can lead to significant savings. Mortgage interest, property taxes, and certain home improvements can often be deducted, reducing your taxable income.

Appreciation Potential: Over time, real estate typically appreciates in value. This appreciation can significantly increase your wealth, especially if you’re in a growing market. It’s a long-term investment that often aligns with general economic conditions.

2. Stability and Predictability

Fixed-Rate Mortgages: With a fixed-rate mortgage, your monthly payments remain the same for the duration of the loan, unlike rent, which can increase annually. This predictability helps in budgeting and financial planning.

Long-Term Residence: Owning a home provides a stable long-term residence for you and your family. This stability can be particularly comforting, knowing you can stay in your home as long as you like without the risk of lease termination or rent hikes.

3. Lifestyle and Flexibility

Personalization: Owning your home means you can customize it to your tastes and needs. Whether it’s painting walls, upgrading fixtures, or renovating spaces, homeowners can create their ideal living environment without needing landlord approval.

Community Ties: Homeowners often feel a stronger connection to the local community. Long-term residency allows you to form lasting relationships and participate in local events and organizations, enhancing your sense of belonging.

4. Privacy and Security

Increased Privacy: Homes typically offer more privacy than rentals. Being a homeowner often means you have greater control over your environment, from who has access to your property to how it’s managed.

Enhanced Security: Owning a home allows you to invest in security systems and make modifications that enhance your personal safety. Additionally, neighborhoods with high rates of homeownership can often have lower crime rates.

5. Emotional Satisfaction and Psychological Benefits

Pride of Ownership: There’s a significant emotional satisfaction that comes with owning a home. It represents stability, success, and personal achievement, which can lead to greater life satisfaction.

Sense of Control: Managing your own property provides a sense of control over your living situation. Homeownership eliminates uncertainties like landlord decisions and the instability of leasing, contributing to mental and emotional well-being.

Conclusion

Owning a home is more than just an investment in real estate; it’s an investment in your future. Whether it’s the opportunity to build equity, the promise of stability, or the freedom to create a space that is truly your own, the benefits of owning a home are substantial and multifaceted. If you’re considering purchasing a home, think about these advantages as you make your decision.

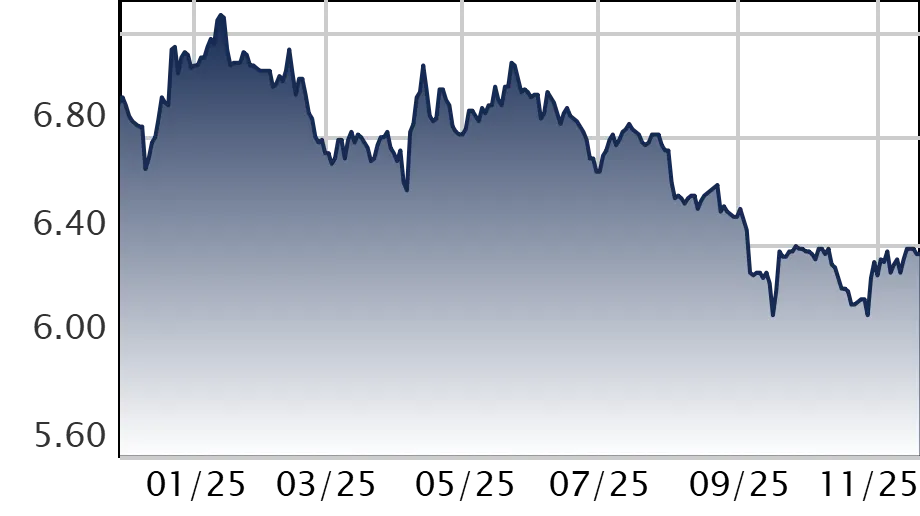

Today's Mortgage Rates

30 Year Fixed

| Product | Avg. Rate | Chg. |

|---|---|---|

| 30 Yr Fixed | 6.36 | -- |

| 15 Yr Fixed | 5.85 | -- |

| FHA 30 Yr | 5.98 | -0.01 |

| Jumbo 30 Yr | 6.43 | -0.01 |

| 7/6 SOFR | 6.05 | +0.02 |

| VA 30 Yr | 5.99 | -0.01 |